First, the good news:

SECURITIES AND EXCHANGE COMMISSION

(Release No. 34-99355; File No. SR-NYSE-2023-09)

January 17, 2024

Self-Regulatory Organizations; New York Stock Exchange LLC; Notice of Withdrawal of Proposed Rule Change to Amend the NYSE Listed Company Manual to Adopt Listing Standards for Natural Asset Companies On September 27, 2023, New York Stock Exchange LLC (the “Exchange” or “NYSE”) filed with the Securities and Exchange Commission (“Commission”), pursuant to Section 19(b)(1) of the Securities Exchange Act of 1934 (“Act”) and Rule 19b-4 thereunder, a proposed rule change to amend the NYSE Listed Company Manual to adopt a new listing standard for the listing of Natural Asset Companies (“NAC”). The proposed rule change was published for comment in the Federal Register on October 4, 2023. On November 7, 2023, pursuant to Section 19(b)(2) of the Act, the Commission designated a longer period within which to approve the proposed rule change, disapprove the proposed rule change, or institute proceedings to determine whether to disapprove the proposed rule change. On December 21, 2023, the Commission instituted proceedings pursuant to Section 19(b)(2)(B) of the Act to determine whether to approve or disapprove the proposed rule change. On January 17, 2024, the Exchange withdrew the proposed rule change (SR-NYSE-2023-09).

For the Commission, by the Division of Trading and Markets, pursuant to delegated

authority.

Sherry R. Haywood,

Assistant Secretary.

Memory Holed from the NYSE web site. Like gloBULL warming, I would expect a rebranding in the near future (link to archived page):

Source: Unlimited Hangout

Wall Street’s Takeover of Nature Advances with Launch of New Asset Class

A project of the multilateral development banking system, the Rockefeller Foundation and the New York Stock Exchange recently created a new asset class that will put, not just the natural world, but the processes underpinning all life, up for sale under the guise of promoting “sustainability.”

by Whitney Webb

October 13, 2021

Last month, the New York Stock Exchange (NYSE) announced it had developed a new asset class and accompanying listing vehicle meant “to preserve and restore the natural assets that ultimately underpin the ability for there to be life on Earth.” Called a natural asset company, or NAC, the vehicle will allow for the formation of specialized corporations “that hold the rights to the ecosystem services produced on a given chunk of land, services like carbon sequestration or clean water.” These NACs will then maintain, manage and grow the natural assets they commodify, with the end of goal of maximizing the aspects of that natural asset that are deemed by the company to be profitable.

Though described as acting like “any other entity” on the NYSE, it is alleged that NACs “will use the funds to help preserve a rain forest or undertake other conservation efforts, like changing a farm’s conventional agricultural production practices.” Yet, as explained towards the end of this article, even the creators of NACs admit that the ultimate goal is to extract near-infinite profits from the natural processes they seek to quantify and then monetize.

NYSE COO Michael Blaugrund alluded to this when he said the following regarding the launch of NACs: “Our hope is that owning a natural asset company is going to be a way that an increasingly broad range of investors have the ability to invest in something that’s intrinsically valuable, but, up to this point, was really excluded from the financial markets.”

Framed with the lofty talk of “sustainability” and “conservation”, media reports on the move in outlets like Fortune couldn’t avoid noting that NACs open the doors to “a new form of sustainable investment” which “has enthralled the likes of BlackRock CEO Larry Fink over the past several years even though there remain big, unanswered questions about it.” Fink, one of the world’s most powerful financial oligarchs, is and has long been a corporate raider, not an environmentalist, and his excitement about NACs should give even its most enthusiastic proponents pause if this endeavor was really about advancing conservation, as is being claimed.

How to Create a NAC

The creation and launch of NACs has been two years in the making and saw the NYSE team up with the Intrinsic Exchange Group (IEG), in which the NYSE itself holds a minority stake. IEG’s three investors are the Inter-American Development Bank, the Latin America-focused branch of the multilateral development banking system that imposes neoliberal and neo-colonalist agendas through debt entrapment; the Rockefeller Foundation, the foundation of the American oligarch dynasty whose activities have long been tightly enmeshed with Wall Street; and Aberdare Ventures, a venture capital firm chiefly focused on the digital healthcare space. Notably, the IADB and the Rockefeller Foundation are closely tied to the related pushes for Central Bank Digital Currencies (CBDCs) and biometric Digital IDs.

The IEG’s mission focuses on “pioneering a new asset class based on natural assets and the mechanism to convert them to financial capital.” “These assets,” IEG states, make “life on Earth possible and enjoyable…They include biological systems that provide clean air, water, foods, medicines, a stable climate, human health and societal potential.”

Put differently, NACs will not only allow ecosystems to become financial assets, but the rights to “ecosystem services”, or the benefits people receive from nature as well. These include food production, tourism, clean water, biodiversity, pollination, carbon sequestration and much more. IEG is currently partnering with Costa Rica’s government to pilot its NAC efforts within that country. Costa Rica’s Minister of Environment and Energy, Andrea Meza Murillo, has claimed that the pilot project with IEG “will deepen the economic analysis of giving nature its economic value, as well as to continue mobilizing financial flows to conservation.”

With NACs, the NYSE and IEG are now putting the totality of nature up for sale. While they assert that doing so will “transform our economy to one that is more equitable, resilient and sustainable”, it’s clear that the coming “owners” of nature and natural processes will be the only real beneficiaries.

Per the IEG, NACs first begin with the identification of a natural asset, such as a forest or lake, which is then quantified using specific protocols. Such protocols have already been developed by related groups like the Capitals Coalition, which is partnered with several of IEG’s partners as well as the World Economic Forum and various coalitions of multinational corporations. Then, a NAC is created and the structure of the company decides who has the rights to that natural asset’s productivity as well as the rights to decide how that natural asset is managed and governed. Lastly, a NAC is “converted” into financial capital by launching an initial public offering on a stock exchange, like the NYSE. This last stage “generates capital to manage the natural asset” and the fluctuation of its price on the stock exchange “signals the value of its natural capital.”

However, the NAC and its employees, directors and owners are not necessarily the owners of the natural asset itself following this final step. Instead, as IEG notes, the NAC is merely the issuer while the potential buyers of the natural asset the NAC represents can include: institutional investors, private investors, individuals and institutions, corporations, sovereign wealth funds and multilateral development banks. Thus, asset management firms that essentially already own much of the world, like Blackrock, could thus become owners of soon-to-be monetized natural processes, natural resources and the very foundations of natural life itself.

Both the NYSE and IEG have marketed this new investment vehicle as being aimed at generating funds that will go back to conservation or sustainability efforts. However, on the IEG’s website, it notes that the goal is really endless profit from natural processes and ecosystems that were previously deemed to be part of “the commons”, i.e. the cultural and natural resources accessible to all members of a society, including natural materials such as air, water, and a habitable earth. Per the IEG, “as the natural asset prospers, providing a steady or increasing flow of ecosystem services, the company’s equity should appreciate accordingly providing investment returns. Shareholders and investors in the company through secondary offers, can take profit by selling shares. These sales can be gauged to reflect the increase in capital value of the stock, roughly in-line with its profitability, creating cashflow based on the health of the company and its assets.”

Researcher and journalist Cory Morningstar has strongly disagreed with the approach being taken by NYSE/IEG and views NACs as a system that will only exacerbate the corporate predation of nature, despite claims to the contrary. Morningstar has described NACs as “Rockefeller et al. letting the markets dictate what in nature has value – and what does not. Yet, it’s not for capitalist institutions and global finance to decide what life has value. Ecosystems are not ‘assets.’ Biological communities exist for their own purposes, not ours.”

A New Way to Loot

The ultimate goal of NACs is not sustainability or conservation – it is the financialization of nature, i.e. turning nature into a commodity that can be used to keep the current, corrupt Wall Street economy booming under the guise of protecting the environment and preventing its further degradation. Indeed, IEG makes this clear when they note that “the opportunity” of NACs lies not in their potential to improve environmental well-being or sustainability, but in the size of this new asset class, which they term “Nature’s Economy.”

Indeed, while the asset classes of the current economy are value at approximately $512 trillion, the asset classes unlocked by NACs are significantly larger at $4,000 trillion (i.e. $4 quadrillion). Thus, NACs open up a new feeding ground for predatory Wall Street banks and financial institutions that will allow them to not just dominate the human economy, but the entire natural world. In the world currently being constructed by these and related entities, where even freedom is being re-framed not as a right but “a service,” the natural processes on which life depends are similarly being re-framed as assets, which will have owners. Those “owners” will ultimately have the right, in this system, to dictate who gets access to clean water, to clean air, to nature itself and at what cost.

According to Cory Morningstar, one of the other aims of creating “Nature’s Economy” and neatly packaging it for Wall Street via NACs is to drastically advance massive land grab efforts made by Wall Street and the oligarch class in recent years. This includes the recent land grabs made by Wall Street firms as well as billionaire “philanthropists” like Bill Gates during the COVID crisis. However, the land grabs facilitated through the development of NACs will largely target indigenous communities in the developing world.

As Morningstar notes:

“The public launch of NACs strategically preceded the fifteenth meeting of the Conference of the Parties to the Convention on Biological Diversity, the biggest biodiversity conference in a decade. Under the pretext of turning 30% of the globe into “protected areas”, the largest global land grab in history is underway. Built on a foundation of white supremacy, this proposal will displace hundreds of millions, furthering the ongoing genocide of Indigenous peoples. The tragic irony is this: while Indigenous peoples represent less than 5% of the global population, they support approximately 80% of all biodiversity.“

IEG, in discussing NACs, tellingly notes that proceeds from a NAC’s IPO can be used for the acquisition of more land by its controlling entities or used to boost the budgets or funds of those who receive the capital from the IPO. This is a far cry from the NYSE/IEG sales pitch that NACs are “different” because their IPOs will be used to “preserve and protect” natural areas.

The climate change panic that is now rising to the take the place of COVID-19 panic will surely be used to savvily market NACs and similar tactics as necessary to save the planet, but – rest assured – NACs are not a move to save the planet, but a move to enable the same interests responsible for the current environmental crises to usher in a new era where their predatory exploitation reaches new heights that were previously unimaginable.

Author

Whitney Webb has been a professional writer, researcher and journalist since 2016. She has written for several websites and, from 2017 to 2020, was a staff writer and senior investigative reporter for Mint Press News. She is contributing editor of Unlimited Hangout and author of the book ‘One Nation Under Blackmail’.

Whitney Webb: How Wall Street Is Monetizing Nature

Courtenay Sounds Alarm On NAC's

Courtenay joins hosts Tony Myers and Richard Grove on episode #166 of Grand Theft World. Sounding the alarm on Natural Asset Companies, and the pending decision by the Securities and Exchange Commission, to legalize voodoo economics and the total theft of the earth's natural resources and land deeds, by the parasitic elite. Literally, Grand Theft World.

Courtenay Draws Battle Line Around NAC's On INFOWARS

Courtenay joins InfoWars host Harrison Smith on American journal, to rally the info warriors to mobilize on all fronts against the impending forces of what the Securities and Exchange Commission, New York Stock Exchange, and the parasite elite seek to unleash throughout the heartland, Natural Asset Companies.Show more

Answer the call to action, by contacting regulatory boards, along with your elected representatives, to sound the alarm on the danger of land grabs.

Ep.365: NAC Battle Won, NWO War Marches On w/ Margaret Byfield

Courtenay is thrilled to have Margaret Byfield back on the show, and so soon! We're proud to announce that the grassroots resistance has scored a major victory, with the New York Stock Exchange withdrawing it's application for the proposed rule change from the Securities and Exchange Commission, that would legalize land theft and worse, with Natural Asset Company classification! Huge WIN! This doesn’t mean we rest and celebrate! It means we stay vigilant! However it’s proof that we can derail the plans of the parasite class!! We can & we must! They felt the pressure here and that’s fantastic!!

Source: Unlimited Hangout

UN-Backed Banker Alliance Announces “Green” Plan to Transform the Global Financial System

The most powerful private financial interests in the world, under the cover of COP26, have developed a plan to transform the global financial system by fusing with institutions like the World Bank and using them to further erode national sovereignty in the developing world.

by Whitney Webb

November 5, 2021

On Wednesday, an “industry-led and UN-convened” alliance of private banking and financial institutions announced plans at the COP26 conference to overhaul the role of global and regional financial institutions, including the World Bank and IMF, as part of a broader plan to “transform” the global financial system. The officially stated purpose of this proposed overhaul, per alliance members, is to promote the transition to a “net zero” economy. However, the group’s proposed “reimagining” of international financial institutions, according to their recently published “progress report,” would also move to merge these institutions with the private-banking interests that compose the alliance; create a new system of “global financial governance”; and erode national sovereignty among developing countries by forcing them to establish business environments deemed “friendly” to the interests of alliance members. In other words, the powerful banking interests that compose this group are pushing to recreate the entire global financial system for their benefit under the guise of promoting sustainability.

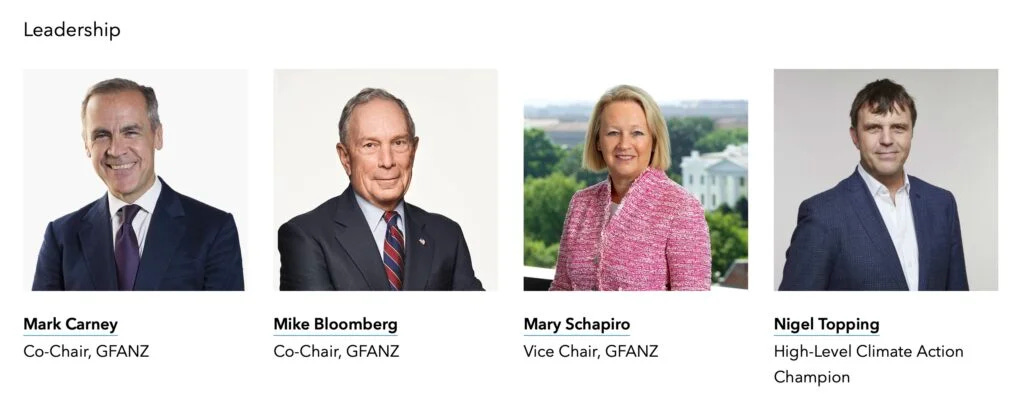

This alliance, called the Glasgow Financial Alliance for Net Zero (GFANZ), was launched in April by John Kerry, US Special Presidential Envoy for Climate Change; Janet Yellen, US Secretary of the Treasury and former chair of the Federal Reserve; and Mark Carney, UN Special Envoy for Climate Action and Finance and former chair of the Bank of England and Bank of Canada. Carney, who is also the UK prime minister’s Finance Advisor for the COP26 conference, currently cochairs the alliance with US billionaire and former mayor of New York City, Michael Bloomberg.

On its creation, GFANZ stated that it would “provide a forum for strategic coordination among the leadership of finance institutions from across the finance sector to accelerate the transition to a net zero economy” and “mobilize the trillions of dollars necessary” to accomplish the group’s zero emissions goals. At the time of the alliance’s launch, UK prime minister Boris Johnson described GFANZ as “uniting the world’s banks and financial institutions behind the global transition to net zero,” while John Kerry noted that “the largest financial players in the world recognize energy transition represents a vast commercial opportunity.” In analyzing those two statements together, it seems clear that GFANZ has united the world’s most powerful private banks and financial institutions behind what it sees, first and foremost, as “a vast commercial opportunity,” the exploitation of which it is marketing as a “planetary imperative.”

GFANZ is composed of several “subsector alliances,” including the Net Zero Asset Managers Initiative (NZAM), the Net Zero Asset Owner Alliance (NZAOA), and the Net Zero Banking Alliance (NZBA). Together, they command a formidable part of global private banking and finance interests, with the NZBA alone currently representing 43 percent of all global banking assets. However, the “largest financial players” who dominate GFANZ include the CEOs of BlackRock, Citi, Bank of America, Banco Santander, and HSBC, as well as David Schwimmer, CEO of the London Stock Exchange Group and Nili Gilbert, chair of the Investment Committee of the David Rockefeller Fund.

Notably, another Rockefeller-connected entity, the Rockefeller Foundation, recently played a pivotal role in the creation of Natural Asset Corporations (NACs) in September. These NACs seek to create a new asset class that would put the natural world, as well as the ecological processes that underpin all life, up for sale under the guise of “protecting” them. Principals of GFANZ, including BlackRock’s Larry Fink, have long been enthusiastic about the prospects of NACs and other related efforts to financialize the natural world and he has also played a key role in marketing such financialization as necessary to combat climate change.

As part of COP26, GFANZ— a key group at that conference—is publishing a plan aimed at scaling “private capital flows to emerging and developing economies.” Per the alliance’s press release, this plan focuses on “the development of country platforms to connect the now enormous private capital committed to net zero with country projects, scaling blended finance through MDBs [multilateral development banks] and developing high integrity, credible global carbon markets.” The press release notes that this “enormous private capital” is money that alliance members seek to invest in emerging and developing countries, estimated at over $130 trillion, and that—in order to deploy these trillions in investment—“the global financial system is being transformed” by this very alliance in coordination with the group that convened them, the United Nations.

Proposing a Takeover

Details of GFANZ’s plan to deploy trillions of member investments into emerging markets and developing countries was published in the alliance’s inaugural “Progress Report,” the release of which was timed to coincide with the COP26 conference. The report details the alliance’s “near-term work plan and ambitions,” which the alliance succinctly summarizes as a “program of work to transform the financial system.”

The report notes that the alliance has moved from the “commitment” stage to the “engagement” stage, with the main focus of the engagement stage being the “mobilization of private capital into emerging markets and developing countries through private-sector leadership and public-private collaboration.” In doing so, per the report, GFANZ seeks to create “an international financial architecture” that will increase levels of private investment from alliance members in those economies. Their main objectives in this regard revolve around the creation of “ambitious country platforms” and increased collaboration between MDBs and the private financial sector.

Per GFANZ, a “country platform” is defined as a mechanism that convenes and aligns “stakeholders,” that is, a mechanism for public-private partnership/stakeholder capitalism, “around a specific issue or geography.” Examples offered include Mike Bloomberg’s Climate Finance Leadership Initiative (CFLI), which is partnered with Goldman Sachs and HSBC among other private-sector institutions. While framed as being driven by “stakeholders,” existing examples of “country platforms” offered by the GFANZ are either private sector-led initiatives, like the CFLI, or public-private partnerships that are dominated by powerful multinational corporations and billionaires. As recently explained by journalist and researcher Iain Davis, these “stakeholder capitalism” mechanism models, despite being presented as offering a “more responsible” form of capitalism, allow corporations and private entities to participate in forming the regulations that govern their own markets and giving them a greatly increased role in political decision making by placing them on an equal footing with national governments. It is essentially a creative way of marketing “corporatism,” the definition of fascism infamously supplied by Italian dictator Benito Mussolini.

In addition to the creation of “corporatist” “country platforms” that focus on specific areas and/or issues in the developing world, GFANZ aims to also further “corporatize” multilateral development banks (MDBs) and development finance institutions (DFIs) in order to better fulfill the investment goals of alliance members. Per the alliance, this is described as increasing “MDB-private sector collaboration.” The GFANZ report notes that “MDBs play a critical role in helping to grow investment flows” in the developing world. MDBs, like the World Bank, have long been criticized for accomplishing this task by trapping developing nations in debt and then using that debt to force those nations to deregulate markets (specifically financial markets), privatize state assets and implement unpopular austerity policies. The GFANZ report makes it clear that the alliance now seeks to use these same, controversial tactics of MDBs by forcing even greater deregulation on developing countries to facilitate “green” investments from alliance members.

The report explicitly states that MDBs should be used to prompt developing nations “to create the right high-level, cross-cutting enabling environments” for alliance members’ investments in those nations. The significantly greater levels of private-capital investment, which are needed to reach net zero per GFANZ, require that MDBs are used to prompt developing nations to “establish investment-friendly business environments; a replicable framework for deploying private capital investments; and pipelines of bankable investment opportunities.” GFANZ then notes that “private capital and investment will flow to these projects if governments and policymakers create the appropriate conditions,” that is, enable environments for private-sector investments.

In other words, through the proposed increase in private-sector involvement in MDBs, such as the World Bank and regional development banks, alliance members seek to use MDBs to globally impose massive and extensive deregulation on developing countries by using the decarbonization push as justification. No longer must MDBs entrap developing nations in debt to force policies that benefit foreign and multinational private-sector entities, as climate change-related justifications can now be used for the same ends.

This new modality for MDBs, along with their fusion with the private sector, is ultimately what GFANZ proposes in terms of “reimagining” these institutions. GFANZ principal and BlackRock CEO Larry Fink, during a COP26 panel that took place on November 2, explicitly referred to the plan to overhaul these institutions when he said: “If we’re going to be serious about climate change in the emerging world, we’re going to have to really focus on the reimagination of the World Bank and the IMF.”

Fink continued:

“They are the senior lender, and not enough private capital’s coming into the emerging world today because of the risks associated with the political risk, investing in brownfield investments — if we are serious about elevating investment capital in the emerging world. . . . I’m urging the owners of those institutions, the equity owners, to focus on how we reimagine these institutions and rethink their charter.”

GFANZ’s proposed plans to reimagine MDBs are particularly alarming given how leaked US military documents show that such banks are considered to be essentially “financial weapons” that have been used as “financial instruments and diplomatic instruments of US national power” as well as instruments of what those same documents refer to as the “current global governance system” that are used to force developing countries to adopt policies they otherwise would not.

In addition, given Fink’s statements, it should not be surprising that the GFANZ report notes that their effort to establish “country platforms” and alter the functioning and charters of MDBs is a key component of implementing preplanned recommendations aimed at “seizing the New Bretton Woods moment” and remaking the “global financial governance” system so that it “promote[s] economic stability and sustainable growth.”

As noted in other GFANZ documents and on their website, the goal of the alliance is the transformation of the global financial system, and it is obvious from member statements and alliance documents that the goal of that transformation is to facilitate the investment goals of alliance members beyond what is currently possible by using climate change-related dictates, rather than debt, as the means to that end.

The UN and the “Quiet Revolution”

In light of GFANZ’s membership and members’ ambitions, some may wonder why the United Nations would back such a predatory initiative. Doesn’t the United Nations, after all, chiefly work with national governments as opposed to private-sector interests?

Though that is certainly the prevailing public perception of the UN, the organization has for decades been following a “stakeholder capitalist” model that privileges the private sector and billionaire “philanthropists” over national governments, with the latter merely being tasked with creating “enabling environments” for the policies created by and for the benefit of the former.

Speaking to the World Economic Forum in 1998, Secretary General Kofi Annan made this shift explicit:

“The United Nations has been transformed since we last met here in Davos. The Organization has undergone a complete overhaul that I have described as a ‘quiet revolution.” . . . A fundamental shift has occurred. The United Nations once dealt only with governments. By now we know that peace and prosperity cannot be achieved without partnerships involving governments, international organizations, the business community and civil society. . . . The business of the United Nations involves the businesses of the world.”

With the UN now essentially a vehicle for the promotion of stakeholder capitalism, it is only fitting that it would “convene” and support the efforts of a group like GFANZ to extend that stakeholder capitalist model to other institutions involved in global governance, specifically global financial governance. Allowing GFANZ members, that is, many of the largest private banks and financial institutions in the world, to fuse with MDBs, remake the “global financial governance system,” and gain increased control over political decisions in the emerging world is a banker’s dream come true. To get this far, all they have needed to do was to convince enough of the world’s population that such shifts are necessary due to the perceived urgency of climate change and the need to rapidly decarbonize the economy. Yet, if put into practice, what will result is hardly a “greener” world but a world dominated by a small financial and technocratic elite who are free to profit and pillage from both “natural capital” and “human capital.”

Today, MDBs are used as “instruments of power” that utilize debt to force developing nations to implement policies that benefit foreign interests rather than their own national interests. If GFANZ gets its way, the MDBs of tomorrow will be used to essentially eliminate national sovereignty, privatize the “natural assets” (e.g., ecosystems, ecological processes) of the developing world, and force increasingly technocratic policies designed by global governance institutions and think tanks on ever more disenfranchised populations.

Though GFANZ has cloaked itself in lofty rhetoric of “saving the planet,” its plans ultimately amount to a corporate-led coup that will make the global financial system even more corrupt and predatory and further reduce the sovereignty of national governments in the developing world.

Author

Whitney Webb has been a professional writer, researcher and journalist since 2016. She has written for several websites and, from 2017 to 2020, was a staff writer and senior investigative reporter for Mint Press News. She is contributing editor of Unlimited Hangout and author of the book ‘One Nation Under Blackmail’.

NAC Attack ✋️ Stopped, Why Vigilance Is Needed w/ Courteney Turner

Today, we are joined by friend of the show, Courtenay Turner, to discuss the NAC attack from a proposed rule at the SEC and why further actions need to be taken by the people.

Beware the SEC's Creation of 'Natural Asset' Companies

OPINION: The SEC Rule on Natural Asset Companies Will Cripple Land Use in America

SEC flooded with comments on natural asset companies

Wall Street’s new plan: Control public lands for ‘climate justice’

Natural Asset Companies proposed rule threatens property rights

GOP AGs denounce trading ‘natural asset companies’ on stock exchange

Natural Asset Companies latest in land schemes

The (il)logical conclusion to commoditizing nature:

Ways to connect

PGP Fingerprint: 7351 9c62 95cc 8130 d8b1 c877 ec99 9aaf 5b1f b029

Email: thetruthaddict@tutanota.com

Telegram: @JoelWalbert

The Truth Addict Telegram channel

Hard Truth Soldier chat on Telegram

The Truth Addict Media Archive (downloadable documentaries, interviews, movies, TV, stand-up, etc)

Mastodon: @thetruthaddict@noauthority.social

Session: 05e7fa1d9e7dcae8512eed0702531272de14a7f1e392591432551a336feb48357c

Odysee: TruthAddict

Rumble: thetruthaddict09

NoAgendaTube: The Truth Addict

Donations (#Value4Value)

Buy Me a Coffee (One time donations as low as $1)

Bitcoin:

bc1qc9ynhlmgxcdd2mjufqr8fxhf248gqee05unmpg (on chain)

nemesis@getalby.com (lightning)

joelw@fountain.fm (lightning)

+wildviolet72C (PayNym)

Monero:

84k3UpLs9mScFSJbPHxx9EiE3xFkz3nhwjCUeHvSZBpTE1nLeJGJzmbAoJANwdLi6zXkXr9NB2DeeNr2dVmuuGdw6gyAx5n