Greetings fellow Plebs & Peasants,

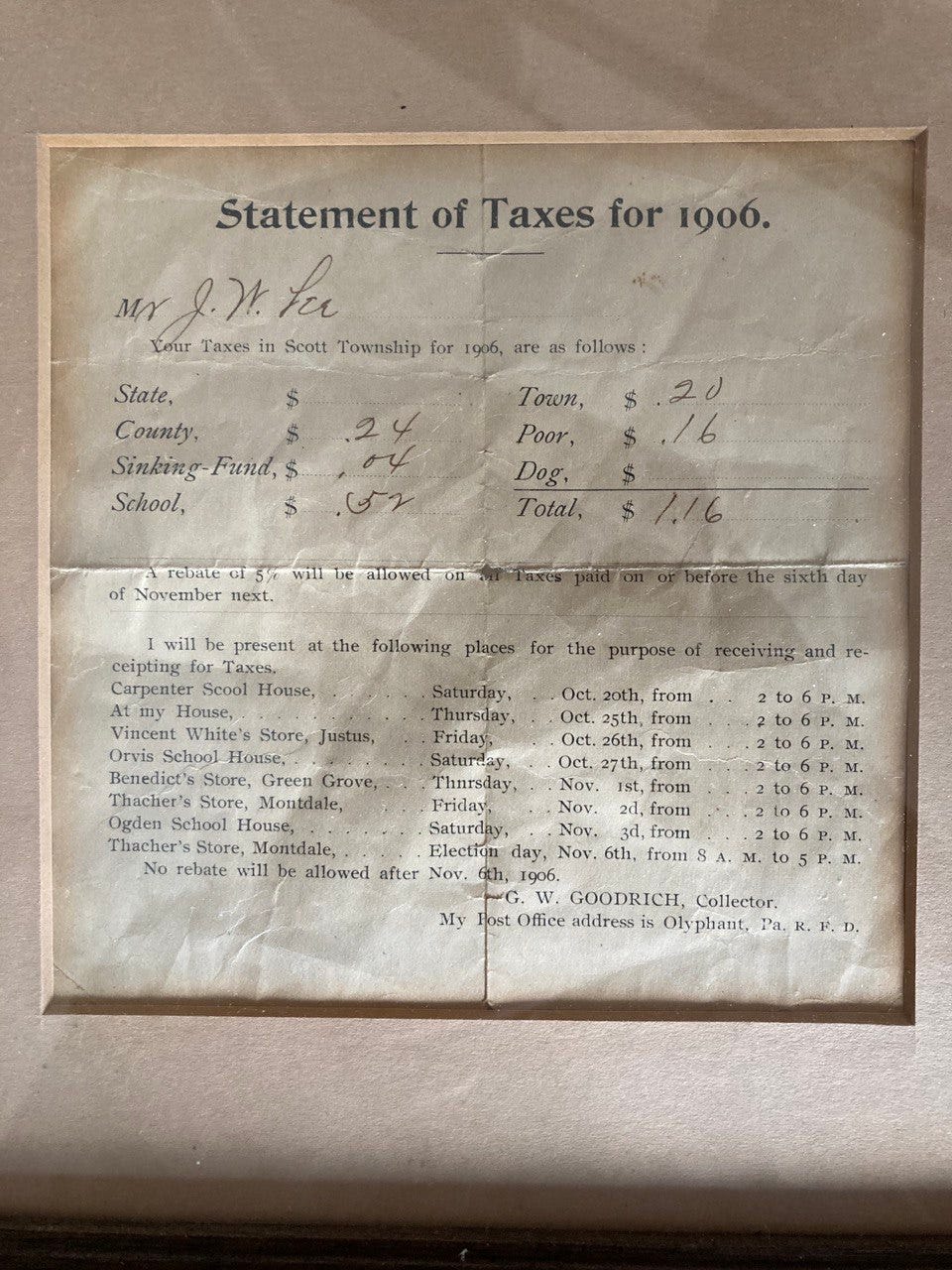

With Strong Armed Robbery & Extortion season coming upon us, I wanted to share this above image as a reminder of the good ole, days, before the federal income tax, before the IRS, and before the Federal Reserve. This is an actual tax statement of my great-great grandfather’s. Why someone in my family decided to keep this and frame it is beyond me, but I am glad he or she did. In case it is lost on anyone, this is the bill for the ENTIRE year. From what I could dig up, average wages back then was 22 cents per hour (more 1907 ‘Fun-Facts’ towards end of post), so unlike today when we work for months to have our taxes paid up (those of us who have it stolen directly from our checks), this bill was paid off with 6 hours work give or take, (assuming avg wages for him, and my family does NOT come from money by any stretch of the term). Now these days people like to say really stupid things like ‘without taxes (or government), how will roads be built?’ or other lame excuses to justify the theft. Well, they had roads and they had police and they had schools and they had a military. But they also had real money that was not yet debased intentionally and there was not yet the gargantuan welfare system in place, whether for individuals or businesses. And unlike these days when countless hours are wasted for tax compliance with people and businesses trying to figure out what they are expected to pay at the risk of an anal reaming known as an audit should one thing be out of place, the actual bill, clearly staing what is owed, was given to people. I also have included a series of quotes taken from the book How Anyone Can Stop Paying Income Taxes by Irwin Schiff (a long time tax (theft) resister who who was left to die in prison from lung cancer and was Peter Schiff’s father for those who know who he is). I had read this maybe a year ago, and let’s just say it tends to be a bit rage inducing as he exposes the outright fraud that is our taxation system.

- jw

#donotcomply #nocompromise #nosurrender

The following quotes are all taken from How Anyone Can Stop Paying Taxes by Irwin Schiff.

Court cases referenced are US Supreme Court unless otherwise noted:

The United States has a system of taxation by confession.

- Supreme Court Justice Hugo Black

The IRS's primary task is to collect taxes under a voluntary compliance system.

- Jerome Kurtz, Internal Revenue Annual Report (1980)

Our tax system is based on individual self-assessment and voluntary compliance.

- Mortimer Caplin, Internal Revenue Audit Manual (1975)

Each year American taxpayers voluntarily fiule their tax returns and make a special effort to pay the taxes they owe.

- Johnnie M. Walters, Internal Revenue 1040 Booklet (1971)

Our tax system is based upon voluntary assessment and payment, not upon distraint.

- Flora v. United States (1959)

To lay with one hand the power of the government on the property of the citizen, and with the other to bestow it upon favored individuals to aid private enterprises and build up private fortunes, is nonetheless a robbery because it is done under the forms of law and is called taxation. This is not legislation. It is a decree under legislative forms.

- Loan Association v. Topeka (1874)

By means which the law permits, a taxpayer has the right to decrease the amount of what otherwise would be his taxes, or altogether avoid them.

- Gregory v. Helvering (1934)

Only the rare taxpayer would be likely to know that he could refuse to produce his records to IRS agents.

- United States v. Dickerson, US COurt of Appeals (1969)

An individual may refuse to exhibit his books and records for examination on the ground that compelling him to do so might violate his right against self-incrimination under the Fifth Amendment and constitute an illegal search and seizure under the Fourth Amendment.

- Handbook for Special Agents, Section 342.12

...Processing tax protester cases is much more difficult than other cases...Tax protesters often have strongly resisted our efforts to obtain information through frequent cancellation and rescheduling of interview appointments; failure to keep scheduled appointments; demanding that all questions and comminications be made in writing; and withholding of records that were speciofically identified and requested by the examiners, thus necessitating the issuance and court enforcement of summonses to obtain any taxpayer and third party records.

- Roscoe L. Egger, former IRS Commisioner (1981)

Who would believe the ironic truth that cooperative taxpayer fares much worse than the individual who relies upon his constitutional rights.

- US v. Dickerson, US Court of Appeals

In a recent conversation with an official at the Internal Revenue Service, I was amazed when he told me that, "If the taxpayers of this country ever discovered that the Internal Revenue Service operates on 90% bluff, the entire system will collapse."

- Senator Henry Bellmon (1969)

I have always thought, from my earliest youth 'til now, that the greatest scourge an angry Heaven ever inflicted upon am ungrateful and sinning people was an ignorant, a corrupt, or a dependent judiciary.

- Chief Justice John Marshall

The history of liberty is the limitation of governmental power, not the increase of it.

- Woodrow Wilson

Source: City-Data.com

Show this to your children and grandchildren

?? THE YEAR 1907 ??

This will boggle your mind, I know it did mine!

The year is 1907. One hundred years ago. What a difference a century makes!

Here are some statistics for the Year 1907:

The average life expectancy was 47 years.

Only 14 percent of the homes had a bathtub.

Only 8 percent of the homes had a telephone.

There were only 8,000 cars and only 144 miles Of paved roads.

The maximum speed limit in most cities was 10 mph.

The tallest structure in the world was the Eiffel Tower!

The average wage in 1907 was 22 cents per hour.

The average worker made between $200 and $400 per year.

A competent accountant could expect to earn $2000 per year, A dentist $2,500 per year, a veterinarian between $1,500 and $4,000 per year, and a mechanical engineer about $5,000 per year.

More than 95 percent of all births took place at HOME .

Ninety percent of all doctors had NO COLLEGE EDUCATION! Instead, they attended so-called medical schools, many of which Were condemned in the press AND the government as "substandard."

Sugar cost four cents a pound.

Eggs were fourteen cents a dozen.

Coffee was fifteen cents a pound.

Most women only washed their hair once a month, and used Borax or egg yolks for shampoo.

Canada passed a law that prohibited poor people from entering into their country for any reason.

Five leading causes of death were:

1. Pneumonia and influenza

2. Tuberculosis

3. Diarrhea

4. Heart disease

5. Stroke

The American flag had 45 stars.

The population of Las Vegas, Nevada, was only 30!!!!

Crossword puzzles, canned beer, and ice tea Hadn't been invented yet.

There was no Mother's Day or Father's Day.

Two out of every 10 adults couldn't read or write.

Only 6 percent of all Americans had graduated from high school.

Marijuana, heroin, and morphine were all available over the counter at the local corner drugstores. Back then pharmacists said, "Heroin clears the complexion, gives buoyancy to the mind, regulates the stomach and bowels, and is, in fact, a perfect guardian of health." ( Shocking? DUH! )

Eighteen percent of households had at least one full-time servant or domestic help.

There were about 230 reported murders in the ENTIRE! U.S.A.!

Now I forwarded this from someone else without typing It myself, and sent it to you and others all over the United States, & Canada, possibly the world, in a matter of seconds! Try to imagine what it may be like in another 100 years if our Lord tarries! IT STAGGERS THE MIND, EH ?

Read more: https://www.city-data.com/forum/other-topics/126270-year-1907-a.html

The Truth About Taxes

This essay originally appeared in the Review of Austrian Economics 7, No. 2 (1994), pp. 75–90, as "The Consumption Tax: A Critique". Narrated by Harold Fritsche. Music by Kevin MacLeod.

Report by the Comptroller General of the United States

Illegal Tax Protesters Threaten Tax System

The number of illegal tax protesters--persons who, according to IRS, advocate and/or use schemes to evade paying taxes--has increased significantly in recent years. Since they represent a threat to our Nation's voluntary tax system, IRS has taken some important counter measures, including the establishment of a high-priority Illegal Tax Protester Program and a program to prevent the filing of false Form W-4s, Employee's Withholding Allowance Certificates.

Ways to connect

PGP Fingerprint: 7351 9c62 95cc 8130 d8b1 c877 ec99 9aaf 5b1f b029

Email: thetruthaddict@tutanota.com

Telegram: @JoelWalbert

The Truth Addict Telegram channel

Hard Truth Soldier chat on Telegram

The Truth Addict Media Archive (downloadable documentaries, interviews, movies, TV, stand-up, etc)

Mastodon: @thetruthaddict@noauthority.social

Session: 05e7fa1d9e7dcae8512eed0702531272de14a7f1e392591432551a336feb48357c

Odysee: TruthAddict

Rumble: thetruthaddict09

NoAgendaTube: The Truth Addict

Donations (#Value4Value)

Buy Me a Coffee (One time donations as low as $1)

Bitcoin:

bc1qc9ynhlmgxcdd2mjufqr8fxhf248gqee05unmpg (on chain)

nemesis@getalby.com (lightning)

joelw@fountain.fm (lightning)

+wildviolet72C (PayNym)

Monero:

84k3UpLs9mScFSJbPHxx9EiE3xFkz3nhwjCUeHvSZBpTE1nLeJGJzmbAoJANwdLi6zXkXr9NB2DeeNr2dVmuuGdw6gyAx5n