Source: Corey’s Digs.

Visa & Mastercard: The Real Threat To The Digital ID Control System

March 11, 2024

By Corey Lynn and The Sharp Edge

The question isn’t whether Visa and Mastercard are at the forefront of the Digital ID control system, the question is whether Visa, Mastercard and central banks will be able to pull it off without the implementation of central bank digital currencies (CBDCs). A “Digital ID” may sound convenient and harmless, but the intention behind it is far reaching – compiling and connecting data and biometrics while removing every form of privacy in order to control how one spends their money, achieves access to services, and ultimately takes control over all assets. This will have an impact on all areas of life, including education, healthcare, food, agriculture, transportation, real estate, and technology, which of course will all be controlled through the Digital ID connected to banks, and a person’s social credit score. This isn’t an imaginary scheme. These intentions are well documented by the Bank for International Settlements (BIS), central banks, the World Bank, financial institutions, credit card companies, and government.

In simple terms, the Bank For International Settlements’ (BIS) blueprint proposes that all private property in the real world, such as money, houses, cars, etc., would be “tokenized” into digital assets within an “everything in one place” global unified ledger. Of course, smart contracts on a “programmable” platform with rules on how each asset can and cannot be used are the key ingredient.

By using fear of cyber attacks on any single institution, big Gov and financial institutions want everyone to believe that consolidating all data and assets of a person’s life into tokens under a Digital ID will somehow protect them from attacks by having everything in one location.

Though many are under the impression that the battle is against the ushering in of CBDCs, it would seem that all of the appropriate financial rails and interoperability are already in place, or darn close to it, to expand on the mountain of identity verification processes already dialed in, to initiate the all-in-one Digital Identity and lock those dominoes into place.

This digital world they intend to manifest is being fashioned to look like a convenient and necessary way everyone must live, and as they build these “rails” of prison cells, consumers are sinking further into debt and relying more and more on credit cards. The Federal Reserve Bank of New York issued a report noting that credit card balances in Q4 of 2023 increased by $50 billion to a record high of $1.13 trillion, while also reporting a rise in delinquencies. The report states that credit card delinquencies increased over 50% in 2023. Total household debt also rose by $212 billion reaching $17.5 trillion in the fourth quarter of 2023, according to the report.

Visa and Mastercard are at the forefront of this takeover and if they succeed, the monitoring, tracking, and control will be immeasurable and there will be no going back. Consumers need to think twice before using credit cards and use cash as often as possible, while state legislators need to get on board with implementing creative legislation with independent systems that not only provide protection for the citizens of their state, but build strong financial freedom with the ability to operate utilizing cash, precious metals, and unique structures as pointed out in this article.

“I get why China would be interested. Why would the American people be for that?” – Neel Kashkari, President of the Minneapolis Federal Reserve, ‘The Threat of Financial Transaction Control,’ the Solari Report, February 24, 2024.

Brief History on Visa & Mastercard

Visa

The first major credit cards emerged from the 50s to mid-60s. Bank of America issued the first consumer credit card with revolving credit in California in 1958, expanding their network through licensing agreements with banks throughout the nation by 1966. The network spread out internationally by 1974, prompting a rebranding in 1976 of the BankAmericard to Visa, an internationally recognized term that conveys universal acceptance.

By 2007, several regional Visa businesses from around the globe merged to form Visa Inc., and the following year, on March 18, 2008, the corporation went public. Visa’s initial public offering (IPO) sold 406 million shares at $44 per share totaling $17.9 billion, one of the largest in U.S. history. Then on March 20, 2008, the underwriters of the IPO, which included JPMorgan, Goldman Sachs, Bank of America, Citi, HSBC, Merrill Lynch, UBS Investment Bank and Wachovia Securities, exercised their over-allotment option by purchasing an added 40.6 million shares, raising the overall IPO shares to 446.6 million for a total of $19.1 billion.

Their Board of Directors includes current and former CEOs, CFOs, and COOs of Carney Global Ventures, Rite Aid Corporation, PepsiCo, Gap, Stanley Black & Decker, Visa, and The Clorox Company.

Over the decades, Visa has faced a myriad of legal actions and disputes concerning anticompetitive practices and high fees. As recently as 2019, a settlement of $5.5 billion was reached in a class-action lawsuit by merchants alleging that Visa and Mastercard engaged in price-fixing practices with regards to swipe fees charged to merchants and the credit card networks unfairly interfered when merchants encouraged less expensive forms of payment such as cash or checks. Additionally, the Department of Justice launched an antitrust probe against Visa in March of 2021. The investigation has remained ongoing according to Visa’s SEC filing in mid-2023.

Mastercard

Competitors to Visa arose in 1966 to form the Interbank Card Association (ICA), which later became Mastercard International. The original bank members were United California Bank, Wells Fargo, Crocker National Bank and Bank of California. The group introduced the Master Charge card which ultimately became known as Mastercard in 1979.

The ICA expanded their network globally, merging with Europay International in 2002 and then converting from a membership association into a private share corporation in preparation for their initial public offering that commenced in 2006. The IPO of 61.5 million shares, priced at $39 per share, raised $2.4 billion. Goldman Sachs coordinated a group of four joint book-runners that included Citigroup, HSBC, and JPMorgan. Co-managing underwriters included Bear Stearns, Cowen and Company, Deutsche Bank, Harris Nesbitt, KeyBanc Capital Markets, and Santander Investment.

Their Board of Directors is made up of current and former CEOs as well as other high level positions from US Bancorp, The Carlyle Group, Mastercard, Verizon, Goldman Sachs, and BeyondNetZero.

Similar to Visa, Mastercard has been plagued by a number of scandals and legal actions over the years. A 2018 report noted that Mastercard brokered a secret multimillion dollar deal with Google to share credit card data for targeted advertising purposes. Then in 2019, as mentioned above, Mastercard and Visa settled a class-action suit worth $5.5 billion for anticompetitive practices. Furthermore, an SEC filing disclosed that, like Visa, the Department of Justice Antitrust Division initiated an investigation into Mastercard in March of 2023.

Visa & Mastercard Play an Integral Role in Digital IDs & CBDCs

Visa

In 2019, Visa launched B2B Connect, which is a platform that uses blockchain to offer financial institutions a streamlined cross-border payment process. The Visa B2B Connect network is designed to offer digital identity solutions and a “centralized system of record for each and every payment.”

Visa has applied for 159 patents related to blockchain which include more secure transactions by using biometric identity verification.

In 2020, Visa filed for a patent to create a digital currency using blockchain, which is designed to replace cash. They aim to act as a central entity computer which creates a digital currency by using a serial number and denomination of physical currency. The patent applies to all digital currencies including: Ethereum, CBDCs, pounds, yen, and euros.

Visa also partnered with Ethereum in 2020 to connect its payment network of 60 million merchants to the U.S. Dollar Coin (USDC) developed by Circle Internet Financial.

In September of 2020, the world’s largest cryptocurrency exchange, Binance, introduced a Visa debit card which automatically converted users’ crypto assets into local currency. Since August of 2023, both Visa and Mastercard stepped back from their partnerships with Binance to offer crypto debit cards amid regulatory scrutiny.

55 out of 106 of Visa’s recent investments were in Fintech – their biggest industry sector for investments.

In May of 2021, Visa announced the expansion of their Fintech Partner Connect program, matching banks that issue Visa cards with fintech companies that offer digital tools to enable their seamless transition toward “the ultimate goal of accelerating adoption of digital-first innovations” which incorporates digital identity verification. Their fintech partners include: Entrust, Alloy, Global Data Consortium, Idemia, Jumio, Neuro-ID, and Onfido (each outlined in more detail below.)

In June of 2021, Entrust, a partner of The Good Health Pass, which was contracted by the UK to produce digital Covid certificates, announced its Visa Ready certified partnership and Visa Fintech Partnership.

Visa’s fintech partner, Alloy, is a “global end-to-end identity risk solution” for banks that “enables instant digital identity verification and document verification.”

Global Data Consortium, which was acquired by the London Stock Exchange Group (LSEG) in April of 2022, is another Visa fintech partner. The acquisition by LSEG was specifically designed to “expand its global range of digital identity solutions.” LSEG offers global identity verification supported by biometric and document verification.

Another Visa fintech partner, Idemia, is a “world leader in biometrics” that provides governments with IDway, which is a “suite of digital identity solutions,” that incorporate several components into a unified system. These components, which include civil registries, ID cards, passports, and welfare registries, work together “as a unified system solution to efficiently manage the identities of a country’s population.”

Jumio is yet another Visa fintech partner that claims to be “the leader in online identity verification” and “way ahead of the game in digital identity as well.” Jumio offers solutions to enable their customers to “issue and verify digital identities from trusted sources,” which include smart wallets.

Visa is also partnered with the fintech company, Neuro-ID, a pioneer “in the field of behavioral analytics,” which launched “breakthrough digital identity products” in February of 2022 that incorporate behavioral data.

Onfido, an additional Visa fintech partner, offers a “Real Identity Platform” for digital identity verification powered by AI, which incorporates both biometric and document verifications.

In January of 2022, Visa partnered with the blockchain technology company ConsenSys to offer central banks a platform to test Central Bank Digital Currencies (CBDCs) and Visa products. The platform can enable a system “for central banks to issue and distribute CBDC.”

In December of 2023, Visa partnered with TECH5, an “innovator in the field of biometrics and digital identity management,” to implement a “digital ID-based payment infrastructure and services on a national level.”

On February 19, 2024, Capital One, a major issuer of both Visa and Mastercard, announced it would acquire Discover in an all-stock deal worth $35.3 billion. If this deal goes through it would make it the largest card issuer when measuring outstanding card loans.

Visa is at the forefront of what they call “the token transformation,” offering “diverse tokenization technologies,” to merchants, regional networks, banks and central banks to “build, manage and control their own tokenization capabilities.” The goal to tokenize all assets, information and people into one global unified ledger is one that the Bank for International Settlements (BIS) has been looking at closely, as evidenced by their 2023 report entitled, “Blueprint for the future monetary system: improving the old, enabling the new.” CBDCs would be “core to the functioning” of this tokenized digital space, serving as the reserve currency on the unified ledger, as noted in the BIS report.

Mastercard

World Bank President Ajay Banga speaking about the need for governments to create digital identities for their citizens (22 min in), at the 2024 World Bank’s Global Digital Summit on March 5th.

The new president of the World Bank, nominated by Biden in February of 2023, is the former CEO of Mastercard, Ajay Banga. As President and CEO of Mastercard, Banga led the company “through a strategic, technological, and cultural transformation. Over the course of his career, Ajay has become a global leader in technology, data, financial services and innovating for inclusion,” the White House announcement states.

Biden also nominated Mastercard’s Chief Legal Officer and Head of Global Public Policy, Richard Verna, to be Secretary of State for Management and Resources in December of 2022.

Mastercard markets the safety and convenience features of a range of Digital Identity Services they offer, which includes their digital ID network, for access to “everything from financial and government services, to healthcare, education, travel, shopping,” and more in what they describe as the “digital transformation.” They have published a number of white papers outlining a variety of use cases for their digital identity services on their site.

61 out of 115 of Mastercard’s recent investments have been in Fintech – their biggest industry sector for investments.

Mastercard and PayPal have a global strategic partnership, providing several services to PayPal users, while PayPal is one of the frontrunners to move the needle on digital IDs considering they are the largest digital wallet company with 69% of Americans using their services.

In 2016, Mastercard and Visa were both part of the multi-stakeholder workshop for the World Economic Forum’s “A Blueprint for Digital Identity: The Role of Financial Institutions in Building The Digital Identity.” On page 41 they describe “identity” as “a collection of pieces of information that describe an entity” such as “age, height, date of birth, fingerprints, health records, preferences and behaviors, telephone metadata, national identifier number, telephone number, email addresses, and assets,” for starters. On page 95 they explain how new capabilities for financial institutions would include: digital identity attributes tied to payment tokens, digital tax filing, and tracking total asset rehypothecation. Mastercard and Visa are both “strategic partners” of the WEF.

In 2018, Mastercard served as one of twenty experts on the UN’s “high-level panel on digital cooperation,’ co-chaired by Melinda Gates and Jack Ma, which produced the report titled “The Age of Digital Interdependence.” The report states that “The immense power and value of data in the modern economy can and must be harnessed to meet the SDGs” (UN sustainable development goals). On page 10 of the report it states “McKinsey & Company studied seven large countries and concluded that digital ID systems could add between 3 and 13% to their gross domestic product.”

In December, 2018, Mastercard partnered with Gavi with the purpose of “efficiently delivering vaccines to millions of children, tracking identity and immunisation records in a digitised manner and incentivising the delivery of vaccines,” by deploying the Mastercard Wellness Pass chip card to those in various countries. It utilizes tokenized biometrics to “adhere to vaccination cycles.” It officially launched in December 2021. Mastercard has made over $50 million in commitments to assist with deployment of the COVID-19 jabs and to carry out the Wellness Pass projects with Gavi.

In March of 2019, Mastercard introduced their new framework for the evolution of digital identities, with their platform operating at the center. Mastercard’s framework envisions their role as a central coordinator bringing together “stakeholders” including banks, governments, and individuals to issue and verify digital identities as a condition for accessing goods and services. In their report, Mastercard says, “we are uniquely positioned as a user champion for digital identity,” considering their “experience in governance and operating networks,” as well as their focus on financial inclusion, data privacy, and investments in a “global infrastructure.” Mastercard says they “will facilitate the service platform and network,” which incorporates “core technologies” such as blockchain and biometrics.

Mastercard representatives contributed to the World Economic Forum’s January 2020 report entitled “Reimagining Digital Identity: A Strategic Imperative,” in which digital identities are central for access to healthcare, financial services, food, travel, humanitarian aid, online activity, government services, phone services, and smart cities.

In September of 2020, Mastercard announced the launch of their CBDCs testing platform for central banks to simulate the “issuance, distribution and exchange of CBDCs between banks, financial service providers and consumers.”

Mastercard collaborated with the Good Health Pass initiative to “develop a blueprint for organizations to adopt and implement” digital health credentials, otherwise known as Covid passports, in 2021.

In April of 2021, Mastercard acquired Ekata for $850 million for the purpose of advancing their digital identity efforts “through AI-powered identity verification.” Ekata is described as a “global leader in digital identity verification solutions that provide businesses worldwide the ability to link any digital transaction to the human behind it.”

In June of 2021, Mastercard launched their E-Livestock digital ID for the cattle supply chain. Digital proof of provenance, which is essentially a digital ID for agricultural products and livestock, is becoming more common. The World Bank, which the former CEO of Mastercard now heads, promotes digital identities for farmers to receive financial assistance as well as to increase tracking of the food supply.

Mastercard’s President of Cyber & Intelligence, Ajay Bhalla, has said, “To truly make the digital world work for all, we must rethink traditional notions of digital identity and break down artificial barriers. We need a new model that starts with the commitment to the fundamental individual right – ‘I own my identity and I control my identity data.’ And we need businesses, governments, NGOs, and others to forge partnerships and invest resources in support of a common framework, principles, and standards.”

In April of 2023, Senior VP of Digital Identity at Mastercard, Sarah Clark, outlined Mastercard’s integral role in digital identities globally. She explained that countries are implementing “trust frameworks” to define the roles of digital identity networks like Mastercard’s. The networks then work to become “accredited” under the “trust framework.” Once “accredited,” Mastercard’s network would integrate with “government ecosystems when it comes to digital identities, digital credentials, as they are brought online.” Each country is unique in their “trust framework.” She said, “In the US it’s a state-based approach,” that is “tethered to the existing driver’s license ecosystem,” which Mastercard is looking “to plug into.” Clark added that government-issued digital identities would not be broadly accepted in some countries due to “the fear of government overreaching and tracking everything you do,” which is why Mastercard advocates for “strong public-private partnerships,” such as theirs, to accelerate public acceptance of digital IDs.

In August of 2023, Sarah Clark elaborated on Mastercard’s progress in the digital identity space, stating that they have been “on the leading edge of the paradigm shift that we can all see is happening today with respect to identity.” She noted that Mastercard’s digital ID network is live in two markets – Australia and Brazil. In Australia, legislation, regulations and the Trusted Digital Identity Framework (TDIF) have paved the way for Mastercard’s digital identity network to be implemented. In June of 2022, Mastercard became the first private organization to receive accreditation under the TDIF. She added that Australia is a “template for other parts of the world” and that Mastercard’s digital identity network has “done pilot activities and prepared for launch in two other markets – the UK and the US.”

Are CBDCs Necessary to Lock in The Digital ID Control System?

Are Visa and Mastercard a driving force for the Digital ID control system? Absolutely, as evidenced above! Are CBDCs necessary in whole or in part for this control system to lock in place or are bank and credit card structures in an all digital system enough to pull this off? That’s the real question. According to the Bank for International Settlements (the bank for the central banks) and the World Bank, it seems plausible and they’ve already made great strides.

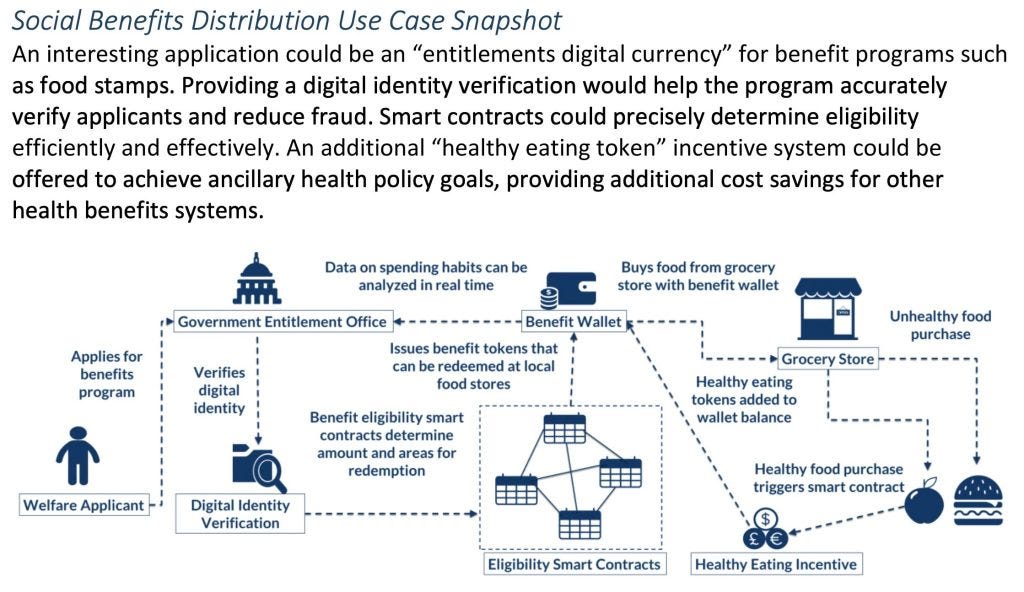

Before delving into those facts, a visual diagram of how choices and access to food could be prohibited under the Digital ID “smart contracts” scheme, may shine a light on how these “helpful tools” would operate in all industry sectors.

Below is a snapshot of Illinois’ plans for digital currency, Digital ID, entitlements, smart contracts, and “healthy eating tokens.” They have several other charts in their strategy document, including drones and other fun stuff. Notice that in this diagram below, when the welfare applicant uses their Digital ID in conjunction with their benefit wallet at a grocery store, the smart contract processes the order while the healthy eating token disallowed a burger from being purchased. Now let your imagination run wild.

One thing people need to realize is that they already have everyone’s data, it’s just a matter of merging it into a single ID that routes to a unified ledger that is integrated with other ledgers so that they all communicate the rules and regulations to one another, giving people an undesired outcome.

In this 2022 Bank for International Settlements (BIS) report they make a very significant statement on page 13 regarding whether a system could be carried out without the use of CBDCs:

“It needs to be noted that many of these features can, in isolation, be offered by other payment innovations, and many gaps could be addressed through regulation and sound oversight arrangements.” CBDCs may not be necessary because “combining different payment innovations such as open application programming interfaces (APIs), fast payment services, contactless chips and QR codes could achieve many of the same goals.” They go on to state, “This is particularly true when accompanied by robust regulatory and oversight arrangements that public authorities can use to catalyse private sector players, enforce sound governance arrangements and foster required coordination and collaboration.”

They sum it up with this: “What is truly different about CBDC is that it is a direct claim on the central bank. It is an open question for central banks whether CBDCs or other policy interventions are the best fit for their jurisdiction.”

In a 2021 World Bank report, they state that a “CBDC network and a fast payments network do not necessarily have to compete. One potential option in this space would be using a CBDC as a settlement currency for a fast payment system. This may be particularly attractive in a cross-border context, where settlement risk is high today due to slow and inefficient processes for cross-border payments.”

Currently, over 60 countries have a “fast payment system” (FPS) in place, and several others have announced their plans to go live. According to the World Bank, “the basic principle among all the countries remains the same — that is, to provide a real-time, 24/7 fund-transfer facility.” The progress and specifics of the FPS systems in each country can be tracked on the World Bank’s global tracker.

In an August 22, 2023 report on BIS’ site titled ‘Financial stability risks from cryptoassets in emerging market economies‘, BIS concluded that “Authorities face a number of policy options to address risks in crypto assets, ranging from outright bans to containment to regulation.”

Also covered in this report, they state “Recently, the industry has been giving more thought to how this technology could be integrated with Fast Payments. For example, some players in the industry believe that connecting the latter to existing distributed ledgers would facilitate programmable Fast Payments.”

This is where the QR codes come into play. If this technology can be programmable, that means central banks can control what you buy, not to mention governments. This was covered in depth in the book titled The Global Landscape on Vaccine ID Passports, by Corey Lynn.

The BIS Innovation Hub is in its fourth year, with five concluded projects and 21 in the works, with 15 of the 26 projects focused on CBDCs. One particular project called Nexus focuses on cross-border payments with the ability to connect all of the Fast Payment Systems so countries can add the Nexus gateway. They ran a 12-month proof of concept between the Eurosystem, Malaysia and Singapore to show how Nexus can accelerate the growth of instant cross-border payments. In their 2023 report they stated that this “opens the door to other alternative payments infrastructure, such as CBDCs, to connect to Nexus.” This was followed up with a report on September 28, 2023 showing the successful test on cross-border wholesale CBDCs that was tested through BIS and central banks of France, Singapore and Switzerland. They state that “this could form the basis for a new generation of financial market infrastructures.”

‘Once they have the Fast Payment Systems connected across countries through a single gateway – utilizing the ISO 20022 messaging system for transactions that has the ability to carry a lot of data, and has assigned a QR code to individuals as a Digital ID that has already migrated each person’s information into one convenient digital location – is it plausible that banks, industries and institutions could roll out smart contracts on services and purchases to facilitate this Digital ID control system without the need for CBDCs? It sure seems plausible.

Mastercard has been working diligently to assist banks all over the world so that they are operating on the new ISO 20022 data standards for transactions, which are to be compliant with messaging for cross-border payment systems by November 2025. They pitch that their “50 years’ experience running and operating technical infrastructure and a scheme, to enable success for other payment ecosystems,” and go on to state they “worked with The Clearing House (TCH) to launch its RTP Network®, which uses ISO 20022 data standards.” Mastercard also brings attention to the fact that “in some markets, such as the United States, mobile person-to-person (P2P) payments have been adopted as an early use case to help grow the scale and reach of real-time payment systems.”

Mastercard points out:

“With ISO 20022 there’s the potential to carry more data across the entirety of the payment itself, whether that is the expanded data fields, associated risk score(s), device analytics or other verifiable metrics that can be used to increase the certainty of a genuine transaction, thus reducing false positives and time-handling exceptions.

The adaptability of the message means there is plenty of scope for customization and localization. This is another potential benefit as it enables different markets to adapt the message to support the specifics of their authority, regulatory regimes and other data requirements.”

This report is sponsored by The Solari Report.

Related Reading:

TAKE ACTION: Steps to Secure Financial Freedom

BIS Blueprint = Global Control of ALL Assets, Information & People

The Rise & Risks of Central Bank Digital Currencies

The Global Landscape on Vaccine ID Passports Part 4: BLOCKCHAINED

Space: The New Frontier For The Central Control Grid

Whitney Webb: Bitcoin And The Plot To Destroy Financial Privacy

Many of these same entities, particularly the U.S. Department of Justice, are also currently helping to draft the UN’s new cybercrime treaty, showing that there is currently a very global effort to stomp out “cybercrime” and alleged funding sources for “cybercriminals”. However, much like the words “terror” and “terrorist” after 9/11, the terms “cybercrime” and “cybercriminals” are often vaguely defined by these same authorities.

Tokenized, Inc: BlackRock's Plan To Own The Fractionalized World

Just one day after the January 11 approval of 11 Bitcoin spot ETFs – including BlackRock’s iShares Bitcoin Trust (IBIT) – by the U.S. Securities and Exchange Commission, BlackRock Chair and CEO Larry Fink sat down with Bloomberg's David Westin to discuss the implications of the world's largest asset manager entering the Bitcoin market. Not one to mince words, Fink articulated a clear framework for his company's approach to Bitcoin, and furthermore for BlackRock's intention to replicate similar ETF products for other assets. “If we can 'ETF' a Bitcoin, imagine what we can do with all financial instruments.” Fink continued, speaking about Bitcoin itself, stating “I don’t believe it’s ever going to be a currency. I believe it’s an asset class.”

https://github.com/vexl-it/fti (Financial Tyranny Index)

Ways to connect

PGP Fingerprint: 7351 9c62 95cc 8130 d8b1 c877 ec99 9aaf 5b1f b029

Email: thetruthaddict@tutanota.com

Telegram: @JoelWalbert

The Truth Addict Telegram channel

Hard Truth Soldier chat on Telegram

The Truth Addict Media Archive (downloadable documentaries, interviews, movies, TV, stand-up, etc)

Mastodon: @thetruthaddict@noauthority.social

Session: 05e7fa1d9e7dcae8512eed0702531272de14a7f1e392591432551a336feb48357c

Odysee: TruthAddict

Rumble: thetruthaddict09

NoAgendaTube: The Truth Addict

Donations (#Value4Value)

Buy Me a Coffee (One time donations as low as $1)

Bitcoin:

bc1qc9ynhlmgxcdd2mjufqr8fxhf248gqee05unmpg (on chain)

lnbc1pjlzvaxpp5lvxg0putv5smxrzd2wckhszeklkahcx8dzqu94adeh3cz50y6vqqcqpjsp557f2656um3l473z4u2sph5hsh5ldpcpl73f3w7rtcgn74jyyylks9q7sqqqqqqqqqqqqqqqqqqqsqqqqqysgqdqqmqz9gxqyjw5qrzjqwryaup9lh50kkranzgcdnn2fgvx390wgj5jd07rwr3vxeje0glcll6nqgupdtf5suqqqqlgqqqqqeqqjqm557pc6k7k946xasteh9zx53jwhrpwlxft8xpu39d03w855vy4xs9qqjv5sa6q5jc26m2te5degyg9f2429y098nj590hvmv93cahvqqf4wfza (lightning)

nemesis@getalby.com (lightning)

joelw@fountain.fm (lightning)

+wildviolet72C (PayNym)

Monero:

8ByhEVizjL2Z7uy2pvgCsqHRpajwx18mQbeCVDtxK94ninbBz7ioFVJCnpdUEk55oV7g1yyLj4RhejSEUN8bfR7b6gbUcnP