Source: Health Freedom Defense Fund

The Story of Pfizer Inc. A Case Study in Pharmaceutical Empire and Corporate Corruption

By Health Freedom Defense Fund

Global Research, July 19, 2023

The extensive history of the pharmaceutical industry is filled with stories and deeds of adventures, misadventures, profit-making, profit-taking, fraud, bribery, false claims, messianic promises, and criminal conduct.

Few companies in the history of medicine have received as much attention as Pfizer Inc. has received these last three years of the Corona Crisis.

Through the course of relentless media coverage and amidst all the sound and fury, Pfizer has managed to avoid scrutiny of its previous criminal conduct and is universally portrayed in the mainstream media as a benevolent enterprise whose mission is to nobly service humanity.

In an effort to set the record straight we embark upon a comprehensive historical examination of this company which sprouted from humble beginnings into one of the most influential corporate behemoths walking the earth today.

(link to full video on Odysee)

History

The story of Pfizer begins in New York City in 1849, when a pair of German immigrants, cousins Charles Pfizer and Charles F. Erhart, received a $2,500 loan from Charles Pfizer’s father to purchase a commercial building in Williamsburg, Brooklyn where they would embark upon a joint business venture in the nascent chemical manufacturing industry.

Charles Pfizer had been a pharmacist’s apprentice in Germany and possessed commercial training as a chemist. Charles Erhart was a confectioner.

Originally named Charles Pfizer and Company the business would initially focus on the production of chemical compounds. Their first product was a pharmaceutical called Santonin which was used to treat parasitic worms.

Combining their talents the cousins housed their product within tasty confections such as candy lozenges and toffee-flavored sugar cream cones. This strategy proved to be a success, setting the stage for the company’s future development.

The drug Santonin would be used as an anthelmintic up until the 1950’s, when it fell out of favor due to noted toxic effects which posed serious risks to patients.

Pfizer would quickly expand into the realm of fine chemicals for commercial sale to wholesalers and retailers.

In 1862, Pfizer would become the first U.S. company to domestically produce tartaric acid and cream of tartar.

With the outbreak of the American Civil War a massive need for painkillers and antiseptics erupted, creating an “opportunity” for the pharmaceutical industry.

Pfizer quickly expanded its production of both, as well as of iodine, morphine, chloroform, camphor, and mercurials. By 1868, Pfizer revenues had doubled and its product line had increased substantially.

The big boon for the company would come in the 1880’s with its production of industrial grade citric acid, widely used in soft drinks like Coca-Cola and Dr. Pepper. This would become the company’s centerpiece and drive their growth for decades.

Another fortuitous change for the “small New York firm” would arrive in 1919, when its scientists would pioneer and develop a deep tank fermentation process, the principles of which would later be applied to the production of penicillin.

This prowess in fermentation and large-scale pharmaceutical production would put Pfizer in a lead position in WW2, when the US government appealed to the pharma industry for support in producing penicillin for the war effort.

Working with government scientists, Pfizer began pursuing mass production of penicillin utilizing its deep-tank fermentation technology and in 1944 became the first company to mass produce penicillin.

As penicillin prices and usage declined post-WW2, Pfizer began searching for more profitable antibiotics. The move into commercial production of antibiotics signaled a pivot in Pfizer’s business model.

The company’s operations shifted from the manufacture of fine chemicals to research-based pharmaceuticals, giving birth to Pfizer’s new drug discovery program, which focused on vitro synthesis.

In 1950 Pfizer would develop its first proprietary pharmaceutical product, Terramycin, a broad-spectrum antibiotic.

By 1951, Pfizer had established offices in Belgium, Brazil, Canada, Cuba, England, Mexico, Panama, and Puerto Rico. As its power and profits mushroomed, Pfizer would augment its portfolio through various acquisitions and entries into multiple areas of research and development, including an animal health division.

As the Pfizer pharmaceutical kingdom expanded, however, questions about salacious business practices began to surface.

Violations

Despite portraying itself as a righteous corporate citizen, Pfizer is no stranger to controversies and scandals. As early as 1958 it was one of six drug companies accused of price fixing by the Federal Trade Commission.

In 1961 the Justice Department filed criminal antitrust charges against Pfizer, American Cyanamid, and Bristol-Myers, accusing top executives at each company of charging egregiously high prices and monopolizing the production and distribution of drugs dating back to 1953.

In 1963 the FTC ruled that the accused companies in its 1958 complaint did in fact rig antibiotic prices. The FTC also noted that “unclean hands and bad faith played a major role”in Pfizer being granted the tetracycline patent.

By the 1960s, Pfizer was at its most diversified point in history, with interests ranging from pills to perfume to petrochemicals to pet products.

The company’s shift toward bringing out new products culminated with the establishment of the Central Research Division in the early 1970s. A full 15% of Pfizer’s revenue was directed to this research department.

This focus on innovation brought about Pfizer’s development of blockbuster drugs, which are described as “drugs that generate at least $1 billion in revenue a year for the pharmaceutical companies that produce them.”

While these drugs can be extremely profitable for pharmaceutical companies, the blockbuster drug business model presents certain long-term problems. Beyond the time and money that goes into their development, there are the exigencies of patent issues. Pharma companies see the “patent window” of 20 years as a severe limitation, since it often takes them a full decade to bring a new drug to market, thus shortening both the time allowed to reclaim profits from development costs and the time allotted to reap maximum profits from their new product.

Due to patent laws, the success of blockbuster drugs is often short-lived. Also, reliance on blockbusters means that if a product fails, the consequences for the manufacturer can be catastrophic.

Using this business model, the need for pharmaceutical companies to constantly produce blockbuster drugs is difficult to overstate. Naturally, they go to great lengths to protect their golden goose.

Accompanying Pfizer’s string of blockbusters was a massive surge in the company’s fortunes in tandem with a procession of controversial products, felony offenses and multiple fines—including the largest criminal fine in US history.

Take, for example, Pfizer’s first blockbuster drug, the anti-inflammatory Feldene, which would also become one of its initial contentious products.

Pfizer submitted a new-drug application for Feldene to the FDA in March 1978 and again in May 1980. The applications were rejected due to poor testing protocols. In September 1981, Pfizer resubmitted an application to the FDA, using old data.

Multiple questions surrounding Feldene, including the route taken toward its ultimate approval, would make it one of Project Censored’s top “Censored” news stories in 2015.

In that story, Project Censored noted:

”Then, while the FDA was still considering the application, Pfizer sponsored a reception at the meeting of the American Rheumatism Association in Boston and showed a film promoting Feldene which the FDA said was illegal. Nevertheless, on April 6, 1982, the FDA approved Feldene for use in the U.S.”

Even though Feldene would go on to become Pfizer’s most lucrative product, questions about the drug quickly surfaced. By 1986 the FDA was being petitioned to relabel the drug due to serious concerns about its long half-life and its tendency to accumulate in the blood.

The watchdog organization Public Citizen Health Research Group (PCHRG) would later charge that this widely prescribed arthritis drug created risks of gastrointestinal bleeding among the elderly.

Citing reports of 2,621 adverse events and as many as 182 deaths among patients taking the drug, PCHRG requested that the FDA ban Feldene for patients 60 and over, “as an imminent hazard to the public health.”

Dr. Sidney Wolfe, director of the PCHRG stated, “At least 1.75 million elderly American people now receiving this drug are at risk of developing life-threatening gastrointestinal reactions.”

Meanwhile, the National Council of Senior Citizens urged the FDA to take the drug completely off the market.

PCHRG’s Wolfe would later cite internal documents from Pfizer that voiced concerns about the drug. By 1995 he called for a complete ban on the drug for all ages.

This was just the beginning of a series of high-profile scandals and legal problems that would come to define Pfizer’s business-as-usual practices.

For instance, reports of serious issues surrounding a heart valve produced by Pfizer’s Shiley division began to plague the company. This problem would result in the cessation of production of all models of the faulty valves by 1986.

A 1991 FDA task force charged that Shiley withheld information about safety problems from regulators in order to get initial approval for its valves. A November 7, 1991, investigation in The Wall Street Journal asserted that Shiley had deliberately falsified manufacturing records relating to valve fractures.

These fractures resulted in catastrophic consequences for numerous patients. By 2012 it was reported that 663 individuals had died as a result of the defective valves.

Pfizer ultimately agreed to pay between $165 million and $215 million to settle lawsuits related to the The Björk-Shiley Convexo-Concave Heart Valve.

It also agreed to pay $10.75 million to settle US Justice Department charges that it lied to regulators in seeking approval for the valves.

The parade of corrupt practices and legal problems that has come to define this pharmaceutical Leviathan was just getting underway. From then on, Pfizer was cited and prosecuted for a litany of illegal acts ranging from price fixing, product safety, bribery, advertising and marketing scandals all the way to environmental and human rights violations.

In 1999 Pfizer pled guilty to criminal antitrust charges and agreed to pay fines totaling $20 million. In that case, Pfizer was charged with “participating in a conspiracy to raise and fix prices and allocate market shares in the U.S. for a food preservative called sodium erythorbate, and to allocate customers and territories for a flavoring agent called maltol.”

In 2000 The Washington Post published a six-part exposé accusing Pfizer of testing a dangerous experimental antibiotic Trovafloxacin (trade name Trovan) on children in Nigeria without receiving proper consent from their parents.

Trovan was slated to become Pfizer’s next blockbuster drug, according to Wall Street analysts, one of whom claimed, “Pfizer might reap $1 billion a year if Trovan could gain approval for all its potential uses.” But when the company was unable to find enough patients in the United States, its researchers went in search of new patients in Kano, Nigeria.

This unapproved clinical trial on 200 Nigerian children resulted in the death of 11 children. It is alleged that many more children later suffered “serious side-effects ranging from organ failure to brain damage.”

In 2001 Pfizer was sued by 30 Nigerian families, who accused the company of using their children as “human guinea pigs.” The families contended that “Pfizer violated the Nuremberg Code as well as UN human rights standards and other ethical guidelines” and alleged that Pfizer exposed the children to “cruel, inhuman and degrading treatment.”

After years of legal battles, Pfizer agreed in 2009 to pay $75 million to settle some of the lawsuits that had been brought in Nigerian courts.

Trovan never became the blockbuster Pfizer had envisioned. The company admitted to stockholders it had “suffered a disappointment” with this experimental meningitis drug. Trovan was never approved for use by children in the United States, so production was halted. The European Union banned it in 1999.

Below is a chronology of still more Pfizer misadventures.

— In 2002 Pfizer agreed to pay $49 million to settle charges that one of its subsidiaries defrauded the federal Medicaid program by overcharging for its cholesterol-lowering drug Lipitor.

— In 2003 Pfizer paid $6 million to settle with 19 states that accused it of using misleading ads to promote the antibiotic Zithromax (also called Z-Pak), used for children’s ear infections. The claim alleged that Pfizer “overstated the benefits and efficiency of Zithromax when compared to other comparable antibiotics.”

— In 2004 Pfizer agreed to a $60 million settlement in a class-action suit brought by users of a diabetic medication developed by Warner-Lambert, which Pfizer acquired in 2000. The drug Rezulin had been withdrawn from the market after numerous patients died from acute liver failure said to be caused by the drug.

— In 2004 Pfizer agreed to halt ads for its painkiller Celebrex, and the following year it admitted that 1999 clinical trials found that elderly patients taking the drug were far more likely to incur risks of heart problems.

— 2004 also saw Pfizer plead guilty to two felonies and pay $430 million in penalties for fraudulently promoting the epilepsy blockbuster drug Neurontin for unapproved uses. Pfizer claimed it could also be used for “bipolar disorder, pain, migraine headaches, and drug and alcohol withdrawal.”

Pfizer’s underhanded tactics involving Neurontin also included bribing doctors with luxury trips and monies to promote the drug and planting operatives at medical education events.

Documents later came to light suggesting that Pfizer arranged for delays in the publication of scientific studies that undermined its claim for the other uses of Neurontin. In one of these documents, it was found that a Neurontin team leader at Pfizer said, “I think we can limit the potential downside of the 224 study by delaying publication for as long as possible.”

Finally, in 2010, a federal jury found that Pfizer committed racketeering fraud in its marketing of Neurontin; the judge in the case subsequently ordered the company to pay $142 million in damages.

— In 2005 Pfizer withdrew its painkiller Bextra from the market after the FDA cited “inadequate information on possible heart risks from long-term use of the drug as well as ‘life-threatening’ skin reactions, including deaths.”

— That same year the FDA approved a black box warning on Pfizer’s other blockbuster painkiller, Celebrex, citing elevated risks of “cardiovascular events and life-threatening gastrointestinal bleeding.”

— In 2007 Pfizer agreed to pay $34.7 million to settle federal charges relating to the marketing of its Genotropin human growth hormone. Pharmacia & Upjohn Co., a Pfizer subsidiary, agreed to pay $19.7 million for “offering a kickback to a pharmacy benefit manager to sell more of the drug,” while Pfizer agreed to pay another $15 million for “promotion of Genotropin for uses not approved by the Food and Drug Administration.”

— In 2008 Pfizer paid out a whopping $894 million fine to settle lawsuits “alleging that its withdrawn Bextra painkiller and widely used Celebrex arthritis drug harmed U.S. patients and defrauded consumers.” Of the total fine, $745 million was set aside to “resolve personal injury claims.”

— The very next year, 2009, Pfizer was fined $2.3 billion gaining the dubious distinction of being tagged with the largest health care settlement in history. GlaxoSmithKline would up the ante with a $3 billion settlement in 2012.

The fine was a combination of civil and criminal settlements relating to Pfizer’s “allegedly illegal promotion of certain drugs, most notably Bextra.” Pfizer pled guilty to “misbranding the painkiller Bextra with the intent to defraud or mislead, promoting the drug to treat acute pain at dosages the FDA had previously deemed dangerously high.”

The Justice Department also noted Pfizer had “allegedly paid kickbacks to compliant doctors and promoted three other drugs illegally: the antipsychotic Geodon, an antibiotic Zyvox, and the antiepileptic drug Lyrica.”

When interviewed by The New York Times, former Pfizer sales representative John Kopchinski, who helped initiate the federal investigation, stated, “The whole culture of Pfizer is driven by sales, and if you didn’t sell drugs illegally, you were not seen as a team player.”

The criminal fine of $1.195 billion in that settlement still represents the largest criminal fine ever imposed in the United States for any matter.

Even after entering an expansive corporate integrity agreement with the Office of Inspector General of the Department of Health and Human Services as part of the 2009 settlement, Pfizer’s unprincipled and injurious behavior continued. The band played on.

In 2010 The New York Times reported on Pfizer’s admission that it had paid around “$20 million to 4,500 doctors and other medical professionals for consulting and speaking on its behalf in the last six months of 2009.”

The Times also mentioned that Pfizer had paid “$15.3 million to 250 academic medical centers and other research groups for clinical trials in the same period.”

In reference to the amounts disclosed by Pfizer, Dr. Marcia Angell, former editor of The New England Journal of Medicine and author of The Truth About the Drug Companies: How They Deceive Us and What to Do About It, admitted that while she had no specific knowledge of the matter, she believed the publicly revealed amounts Pfizer disclosed “seemed low.” She added: “I can’t help but think something has escaped.”

In 2011 Pfizer agreed to pay $14.5 million to resolve False Claims Act accusations that it illegally marketed its bladder drug Detrol.

In 2012 the U.S. Securities and Exchange Commission announced that it had reached a $45 million settlement with Pfizer to resolve charges that its subsidiaries had bribed overseas doctors and other healthcare professionals.

The SEC alleged that “employees and agents of Pfizer’s subsidiaries in Bulgaria, China, Croatia, Czech Republic, Italy, Kazakhstan, Russia, and Serbia made improper payments to foreign officials to obtain regulatory and formulary approvals, sales, and increased prescriptions for the company’s pharmaceutical products.”

According to Kara Brockmeyer, Chief of the SEC Enforcement Division’s Foreign Corrupt Practices Act Unit, “Pfizer subsidiaries in several countries had bribery so entwined in their sales culture that they offered points and bonus programs to improperly reward foreign officials who proved to be their best customers.”

In 2012, Pfizer was hit with another massive fine—this time to settle claims that the side effects of its Hormone Replacement Therapy (HRT) drug Prempro cause breast cancer. Around 10,000 women filed a lawsuit against the company, alleging that the drug maker withheld information about the potential risks of breast cancer from HRTs. The $1.2 billion settlement came after six years of trials.

In 2013, Pfizer agreed to a $288 million settlement for claims by 2,700 people that its smoking-cessation drug Chantix caused suicidal thoughts and severe psychological disorders.

The FDA had placed a black box warning on Chantix, the highest safety-related warning assigned by the FDA, “to alert patients and doctors to the risk of psychiatric side effects” and had noted that the drug is “probably associated with a higher risk of a heart attack.”

Pharmaceutical companies make every effort to circumvent black box warnings. They generate bad publicity and negatively impact the marketability of the drug in question, which leads to adverse financial consequences for the company.

In 2016, after years of lobbying, Pfizer managed to get the FDA to lift the black box designation from Chantrix in a 10-9 vote, giving the controversial blockbuster drug a “new lease on life.”

In 2013 Pfizer reached a $35 million settlement relating to the alleged improper marketing and promotion of the immunosuppressive drug Rapamune. When New York Attorney General Eric T. Schneiderman announced that he and 40 other state attorneys general had arrived at the settlement, he remarked, “There has to be one set of rules for everyone, no matter how rich or powerful, and that includes big pharmaceutical companies that make unapproved and unsubstantiated claims about products in order to boost profits.”

While this article’s list of Pfizer’s corporate crimes is prodigious by any measure of shady business practices, it is far from exhaustive. In total, since 2000 Pfizer has accumulated $10,945,838,549 in penalties and incurred 96 violations covering a wide range of offenses.

A Company You Can Trust?

Pfizer’s portfolio of corporate crimes rivals that of the most corrupt companies in history. But that did not stop Pfizer from becoming a corporate celebrity with its COVID-19 vaccine. Indeed, the company has benefited handsomely from that product, whose $36.8 billion in 2021 sales made it the highest-selling pharmaceutical product in history.

When the pharma company’s 2022 revenues reached an all-time, single-year high of $100.3 billion, COVID-19 vaccine sales accounted for nearly 38 percent of those revenues.

Yet, while Pfizer was basking in the glow of mainstream media cheerleading and record-setting profits, honest inquiries into its unremitting record of corruption were kept from public view.

We were told we must “Trust in Pfizer” to vaccinate the world and save humanity from the so-called COVID crisis.

Given Pfizer’s documented record of misdeeds, any reasonable person would ask:

“Is this a company that belongs behind the wheel of the most widespread mass vaccination campaign in history?”

“Is this a company we should trust with experimental medical technology?”

“Is this a company we want to be in control of the most radical mass medical experiment in human history?”

“How is it that a company that habitually engaged in such illegal practices was able to reinvent itself as the savior of humanity?”

In a June 12, 2008, ceremony, at the original Pfizer manufacturing site in Brooklyn, New York, the American Chemical Society designated Pfizer’s development of deep-tank fermentation as a National Historic Chemical Landmark.

At that commemoration, then-president of Pfizer Global Manufacturing Natale Ricciardi told attendees, “We have always had a very noble mission.” Despite cryptically lamenting, “A lot of things have changed at Pfizer, and unfortunately, we had to make certain decisions,” Ricciardi went on to assert, “But the nobility of what we do, the nobility of what has been done and continues to be done has never changed and will never change.”

All these years later—and despite Mr. Ricciardi’s insistence on Pfizer’s magnanimity—a thinking person might look through the company’s checkered catalog of crimes and fines and recognize that noble experiments are hardly the realm of “alleged” serial felons like Pfizer.

Source: Brownstone Institute

Who Owns BioNTech?

By Robert Kogon

June 12, 2023

audio version:

So, now that it has been established that the main profiteer in the Covid-19 “vaccine” gold rush of the last two years is not Pfizer, but rather the still astonishingly little-known and previously tiny German firm BioNTech, it would appear that something needs to be said about who owns BioNTech.

As shown in my earlier article here, for 2021 and 2022 combined, BioNTech earned over $31 billion in Covid-19 “vaccine” profits on a whopping 77 percent profit margin as compared to Pfizer’s roughly $20 billion on an estimated 27.5 percent profit margin.

This revelation, however, has led many commentators on social media to suggest that none other than Bill Gates was somehow the main beneficiary of – and presumably eminence grise behind – BioNTech’s astronomic rise or even that BioNTech is a “Gates company.”

While it is true that the Gates Foundation – not Gates personally – invested in BioNTech in a deal that, as will be seen below, was likely brokered by the German government, and while that deal is indeed curious for its timing and some of its details, its purely economic significance has been wildly exaggerated.

As of December 30, 2020, the Gates Foundation’s initial holdings of 1,038,674 BioNTech shares represented a mere 0.43 percent of the company’s total stock, as the below Yahoo Finance chart makes clear.

This placed the Gates Foundation among the top institutional investors in BioNTech at the time. But that such relatively paltry holdings could qualify an organization as a top institutional holder is itself indicative of a far lesser-known fact about BioNTech: namely, that it is a very closely held company, the great majority of whose shares are owned by just three people.

Consequently, only a very limited portion of BioNTech shares have ever been available for purchase by the Gates Foundation or anyone else.

The three principal shareholders are CEO Ugur Sahin and Germany’s Strüngmann twins, Andreas and Thomas, who provided much of the initial seed capital for the company’s founding in 2008.

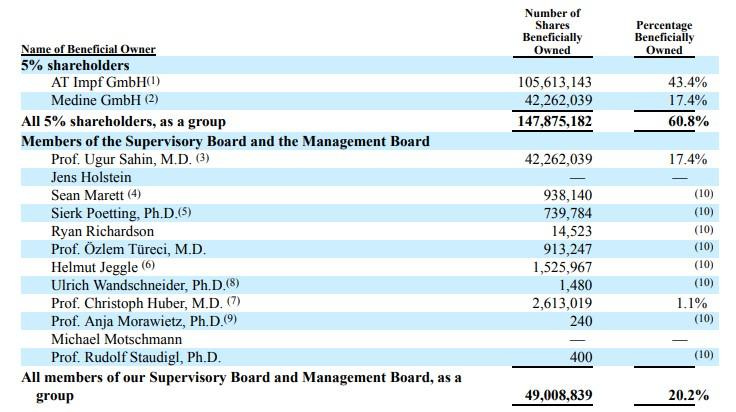

According to BioNTech’s latest annual report to the SEC (p. 192), the Strüngmanns own 105,613,143 shares representing 43.4 percent of BioNTech’s total stock: i.e., literally 100 times more than the Gates Foundation held! Sahin owns 42,262,039 shares representing 17.4 percent of the company’s stock. Together, Sahin and the Strüngmanns thus control nearly 61 percent of BioNTech stock.

The Strüngmanns are AT Impf in the below table. AT Impf is a fully-owned subsidiary of the twins’ ATHOS KG family office. Sahin is the sole shareholder of Medine.

Furthermore, as footnote 1 to the table specifies, “ATHOS KG via AT Impf GmbH has de facto control over BioNTech based on its substantial shareholding, which practically enabled it to exercise the majority of voting rights to pass resolutions at our Annual General Meeting.”

So, in short, BioNTech is not a “Gates company,” but rather literally a Strüngmann company, the Gates Foundation’s stake having always been extremely minor.

As discussed in a much-cited Substack post by Jordan Schachtel, the Gates Foundation has since sold off 890,000 shares in BioNTech, representing 86 percent of its previous holdings. Based on timing and the evolution of the BioNTech share price, Schachtel estimates that the foundation made $260 million on the sale or a whopping 1,500 percent return on its initial investment.

It is this windfall that makes Gates appear like the main beneficiary of BioNTech’s sudden success in the often fact-deprived atmosphere of social media. But, needless to say, the Strüngmanns are the main beneficiaries of BioNTech’s success.

Indeed, as was widely reported in the German media at the time, the precipitous rise in BioNTech’s share price briefly catapulted the twins into the position of the richest people in Germany, with an estimated net worth of €52 billion or $62 billion, when the share price was at its highest in late 2021. Their BioNTech holdings alone were reported to be worth over €42 billion. (See, for example, the report in the German weekly Stern here.)

Of course, the BioNTech share price has since fallen back down somewhat closer to earth. But the twins do not appear to have been averse to getting some cold hard cash out of their investment while the share price was high either.

Thus, circa December 2020, when the Gates Foundation still held all of its initial holdings and 0.43 percent of BioNTech stock, the Strüngmanns twins in fact held 114,410,338 shares or nearly 47.4 percent of BioNTech stock. (See page 201 of BioNTech’s 2020 annual report here.) This means that the twins have in the meanwhile divested themselves not of nearly 900,000 shares, like the Gates Foundation, but of nearly 9 million.

We know, moreover, from other SEC filings that they sold the great bulk of the shares (over 8 million) precisely in 2021, the year in which the BioNTech share price reached its peak. Depending on the exact timing then, they presumably made roughly ten times more than Gates – i.e., a haul of over $2 billion as opposed to the Gates Foundation’s $260 million – and not for the benefit of any non-profit organization, but strictly for their own.

Furthermore, the Gates Foundation was not the only BioNTech partner to have apparently thought better about having too substantial a tie-up with BioNTech in the longer term. So too did none other than the Chinese pharmaceutical company Fosun Pharma.

This is also relevant to our topic, since Fosun – or allegedly even, via Fosun, the Chinese Communist Party! – is likewise often identified in social media posts and by certain commentators as somehow the “real” owner of BioNTech.

It is not and has never been anything of the sort. Rather, as part of its 2020 agreement with BioNTech to commercialize that latter’s Covid-19 vaccine on the Chinese market, it, like the Gates Foundation, acquired a minor equity stake in the German company.

That agreement, however, has largely remained a dead letter, since Chinese authorities have never even approved the vaccine for use on the mainland. This might have something to do with the fact that late last year the Chinese company sold off more than two-thirds of the 1,576,000 BioNTech shares it originally held. Per the calculation of the Chinese market specialists at Bamboo Works, this left Fosun with a mere 0.2 percent stake in BioNTech. So much for Chinese “control” of the company…

What, then, of the famous September 2019, pre-IPO equity deal in which the Gates Foundation acquired its holdings in BioNTech? How did Gates know to invest in a company that had never even gotten close to bringing a product to market, had only ever run losses – and was focused on developing cancer treatments, not vaccines against infectious diseases, to boot! Hardly anyone had ever even heard of BioNTech.

Well, the below image provides a clue.

It comes from the closing plenary session of the October 2018 World Health Summit: a German-government-sponsored event, which is held every year in Berlin. (See the World Health Summit “highlight” video here.) The host institution is Germany’s premier university teaching hospital, the Charité, the chair of whose virology department is none other than Christian Drosten. It is Drosten, of course, who devised the famous PCR protocol that the WHO would adopt as the “gold standard” for detecting Covid-19 infections.

In addition to then German Chancellor Angela Merkel at center stage, you will, of course, notice Bill Gates (whose Grand Challenges network co-hosted the session) directly to her right and WHO Director-General Tedros, a bit further away to her left.

But it is the man without a tie directly to Tedros’s left who is of particular interest to us here. For that is none other than BioNTech CEO Ugur Sahin.

It was the 2018 World Health Summit under the patronage of Chancellor Merkel that brought together Gates and Sahin. It is unlikely that Gates had ever heard of Sahin or his company before then either.

The German government, on the other hand, knew Sahin and BioNTech very well. For, as touched upon in my November 2021 article here, the German government was the company’s state sponsor, both sponsoring its very founding and helping to keep it afloat with subsidies during the many years when BioNTech produced nothing.

Author

Robert Kogon is a pen name for a widely-published financial journalist, a translator, and researcher working in Europe. Follow him at his Twitter here. Robert Kogon also writes at edv1694.substack.com.

Ways to connect

Telegram: @JoelWalbert

Email: thetruthaddict@tutanota.com

The Truth Addict Telegram channel

Hard Truth Soldier chat on Telegram

Mastodon: @thetruthaddict@noagendasocial.com

Session: 05e7fa1d9e7dcae8512eed0702531272de14a7f1e392591432551a336feb48357c

Odysee: TruthAddict

Donations (#Value4Value)

Buy Me a Coffee (One time donations as low as $1)

Bitcoin:

bc1qe8enf89g667dy890j2lnt637xqlt9wvc9f07un (on chain)

nemesis@getalby.com (lightning)

joelw@fountain.fm (lightning)

+wildviolet72C (PayNym)

Monero:

43E8i7Pzv1APDJJPEuNnQAV914RqzbNae15UKKurntVhbeTznmXr1P3GYzK9mMDnVR8C1fd8VRbzEf1iYuL3La3q7pcNmeN